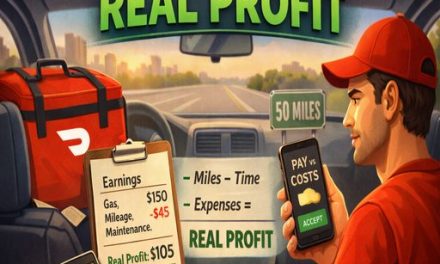

Today I believe most people know that everyone that earns an income must pay taxes, the issue for some is they aren’t sure exactly what they should be tracking so they can maximize their deductions come tax time.

Some people take a just guess when it comes to taxes & what deductions they should have or go off social media post on what they can & can not legally deduct. Some aren’t even sure if they should track certain income.

Income source examples:

- Monetary gifts (over a certain amount)

- Side business or gig work

- Garage sales

- Ebay & Amazon sales

- Cash back & online rewards

- Bank interest

- Rental property income

So what is the best solution? You could just get a box, scan all your receipts & manually input them into a spreadsheet, so at tax time you have them all, but that is so 2000. We have an option below that will help you track your income, expenses and maximize your tax deductions all by using income trackers.

how to use an income tracker

If you are over 40 then you probably remember the days of writing things down in small notebook according to each month. Then manually calculate the final number at the end, and determine how much you could save (after expenses).

Technology came along and gave you excel spreadsheets which were really just about the same thing as the notebook, you still kept all your receipts, manually input them into a spreadsheet, tabbing each month and keeping up with all your income/expenses.

![]()

Well once again technology is making things easier for us, today we have all different types of income trackers for your IPhone & Android devices as well as web browsers. Most of them are as simple as link your bank account to the service then each time you have a transaction the income tracker will ask you if it is a business expense or personal. Some income trackers go even further than that, allowing you to send invoices and even receive payments via credit card.

While there are plenty of free income trackers on the app stores, they typically come with a lot of ads or they sell your data off in order to make money, so free isn’t always best. Most of the free income trackers also do not link to your bank account, so you will have to go back to the manual way of tracking data.

As far as paid goes, we believe the best one out for self employed gig workers is Keeper Tax.

Why we choose it Keeper Tax is great for the self-employed and stands out for a few reasons. Keeper Tax helps independent contractors, freelancers, and solopreneurs, automatically find tax deductions most people miss. Keeper Tax automatically monitors your purchases for write-offs you would have missed. At tax time, file directly through keeper tax, or seamlessly export your savings. Every Keeper Tax customer is assigned to a (book) Keeper who monitors your purchases throughout the year. A couple times per week, you’ll get a text with a simple yes / no question. That’s that simple. Come tax time, save yourself the headache of inputting tax deduction totals into traditional tax software by filing directly through Keeper Tax. If you have an accountant, you’re welcome to export a spreadsheet instead. Click Sign Up Now to get started. |

Looking for something that will track income & expenses, Quickbooks Self-Employed would be the app you are looking for, while the cost is slighty higher it does have a few more options.

Why we choose it QuickBooks Self-Employed stands out for a few reasons. It’s one of the most popular apps available, with 10 million+ users. The software is very easy to use for everyone as well. You can also send invoices, track income & expenses, as well as find tax deductions. The software can also track your mileage and generate reports, as well as give you an estimate of how much you will owe for taxes. Click Sign Up Now to get started with your 50% discount. |

Both choices are great, what makes them even better is the cost of the subscription is a tax deduction as well, which I am sure each service would point out to you.