Do you need income protection?

Each year millions of people find themselves unable to work due to accidents, serious illness, injuries or in the gig economy, temporary deactivation from your gig-working app. Income protection is designed to give you some cover if you can’t earn income for those reasons. If something happened would you be able to survive on your savings? If not, you’ll need some other way to pay the bills and you might want to start considering income protection.

What is income protection?

What exactly is income protection? Income protection plans are designed to help you replace a percentage of your income should you have post accident car repairs, hospitalization or temporary deactivation from your gig-working app. Simply put, they give you money when you can’t go get it yourself.

Where do I get it?

While there are many plans out there, we of course promote our own plan, Middleton Tech Protects, which is a short-term income protection plan that replaces part of your income if you can’t work for the following:

- Collision Repairs

Replaces 80% of your lost income while your vehicle is being repaired due to a collision.

- Deactivation

Replaces 80% of your lost income while you’re temporarily suspended by a gig-working app.

- Hospitalization

Replaces 80% of your lost income when your hospitalized due to an unforeseeable event.

- Unlimited amount of claims

While some protection policies have a limitation of the amount of claims you can have, with Middleton Tech Protects you are not limited to anything except the per month coverage amount and it must be a qualifying event.

- No waiting Period

Unlike traditional income protection policies, there is not waiting period for you to file a claim should you need it, as long as the event was after your plan became active.

- You don’t have to be working

One of the best things about the plan is you don’t even have to be working at the time of the event in order to use it, it is active 24 hours a day so you are always covered.

Is this insurance?

The most common question about these plan is “is this insurance?”, no, this is income protection, it only covers your income, not your medical bills or car repairs.

Do you need it?

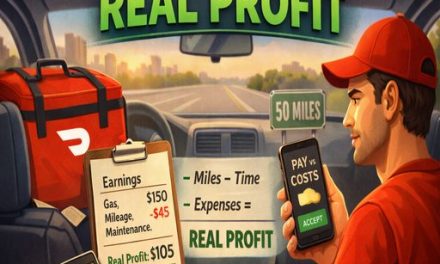

As a driver or delivery person, you’re constantly on the go, many times working for multiple platforms. Accidents, hospitalization, and deactivation can happen, often through no fault of your own. If a car accident, deactivation or illness means you couldn’t pay the bills, you should consider income protection.

Who doesn’t need it?

You might not need income protection if:

- You have enough savings to support yourself. Remember that you will have to replace the income in your saving again should you use it, with Middleton Tech Protects you never have to pay it back.

- Your partner or family would support you. Perhaps your partner has enough income to cover everything your family needs.

How much does it cost?

Middleton Tech Protects offers a monthly income protection plan for $19/month, that is just $0.63 cents per day. For a price lower than one water bottle, soda or coffee a day, you will get income protection for up to $1900 each month, with no restrictions on how many claims you can have. Find out more information at the official site HERE or click the image below.